Traditionally, logistics was viewed as an unavoidable cost – a necessary evil in getting products from point A to point B. However, forward-thinking companies now recognise that a well-managed logistics operation can significantly improve financial performance.

The ROI of Logistics

At the heart of this transformation is the impact of logistics on Return on Investment (ROI).

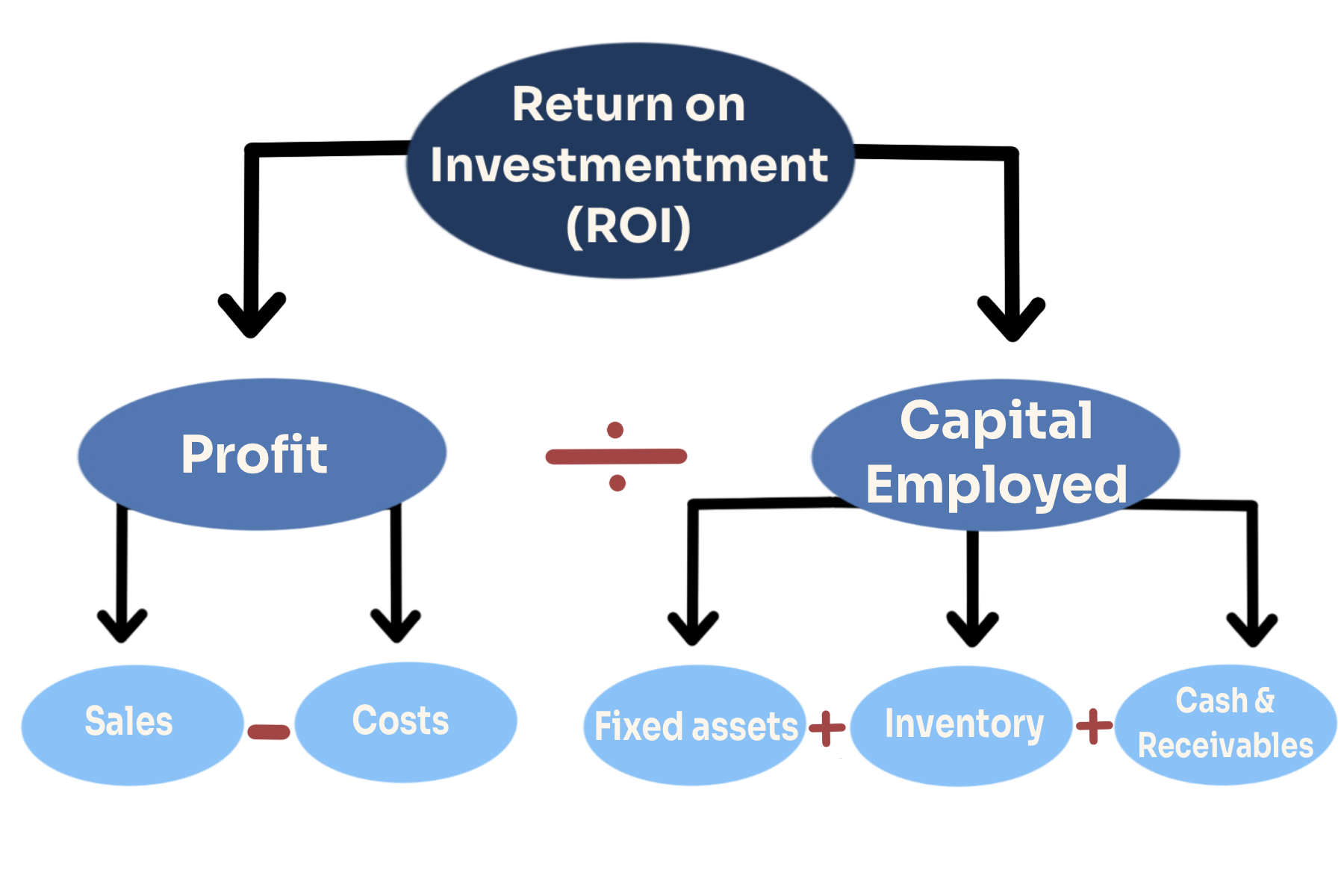

The image below illustrates how logistics impacts an organisation’s ROI.

Let’s break it down:

Return on Investment (ROI).

This is the primary financial metric, calculated by dividing profit by capital employed.

Profit.

Profit = Sales – Costs

- Sales.

Logistics can boost sales through:

- On-Time-In-Full (OTIF) Deliveries: Consistently meeting customer expectations can lead to increased satisfaction and repeat business.

- Enhanced Service Levels: Offering faster or more reliable delivery options can set you apart from competitors.

- Stronger Customer Relationships: Regular communication about deliveries builds trust and loyalty.

- Efficient After-Sales Service: Quick resolution of issues can turn challenges into opportunities for customer retention.

- Costs.

Logistics can reduce costs through:

- Inventory Holding: Implementing just-in-time delivery reduces warehouse costs.

- Storage Efficiency: Automated systems can lower labour costs and improve space utilisation.

- Transport Optimisation: Route planning software can cut fuel consumption and delivery times.

- Labour Efficiency: Technologies like pick-to-light systems boost worker productivity.

- Strategic Depot Locations: Thoughtful placement of distribution centres minimises transportation costs.

- Reducing Obsolescence: Data-driven inventory management prevents costly overstocking.

Capital Employed.

Capital employed comprises three main components: inventory, cash and receivables and fixed assets.

- Inventory.

Efficient logistics can reduce capital tied up in inventory through:

- Raw Materials: Vendor-managed inventory reduces stock levels.

- Work-in-Progress: Lean production techniques minimise partially completed products.

- Finished Goods: Strategies like print-on-demand reduce unsold stock.

- Cash and receivables.

Logistics impacts this through:

- Cash-to-Cash Cycle: Negotiating better payment terms with suppliers improves cash flow.

- Order Cycle Time: Streamlined fulfilment processes reduce the gap between payment and shipping.

- Invoice Accuracy: Automated systems reduce billing errors and payment delays.

Fixed assets.

Logistics can optimise fixed assets through.

- Warehouse efficiency: Vertical storage systems increase capacity without expanding floor space.

- Transport Fleet Management: A mix of owned and leased vehicles optimises asset utilisation.

- Handling Equipment: Modern equipment improves efficiency and throughput.

- Network Optimisation: Reconfiguring distribution networks can dramatically improve overall efficiency.

- Outsourcing: Using third-party logistics providers can reduce capital tied up in assets.

By optimising these various aspects of logistics, organisations can significantly improve their ROI, balancing increased sales and reduced costs with efficient use of capital.

Case Study

TechGadget Ltd., a mid-sized electronics manufacturer, was struggling with declining profits and high operational costs. Their logistics operations were viewed as a necessary expense, but not an area for potential improvement. However, a new Chief Operations Officer saw an opportunity to transform their logistics from a cost centre into a driver of financial performance.

Initial Situation

- ROI: 8%

- Annual Profit: $5 million

- Capital Employed: $62.5 million

- Customer complaints about late deliveries were increasing

- Inventory levels were high, tying up significant capital

Logistics Transformation

- Inventory Optimisation: Implemented a just-in-time inventory system, reducing average stock levels by 30%.

- Distribution Network Redesign: Consolidated five small warehouses into two strategically located distribution centres, reducing fixed asset costs and improving delivery times.

- Transport Management: Invested in route optimisation software, reducing fuel costs by 15% and improving on-time deliveries.

- Customer Service Enhancement: Introduced real-time tracking for all shipments, significantly improving customer satisfaction and reducing service-related queries.

- Supplier Collaboration: Worked closely with key suppliers to align production schedules, reducing lead times and improving cash flow.

Results After One Year

- ROI increased to 13.5%

- Annual Profit rose to $7.5 million (50% increase)

- Capital Employed reduced to $55.5 million (11% decrease)

- On-time delivery rate improved from 85% to 98%

- Customer satisfaction scores increased by 25%

Financial Impact Breakdown

- Profit Increase:

- Sales grew by 10% due to improved service levels and faster delivery times

- Costs decreased by 8% through more efficient transportation and warehouse operations

- Capital Employed Reduction:

- Inventory value decreased by $5 million due to better stock management

- Fixed assets reduced by $2 million through warehouse consolidation

- Profit Increase:

Key Takeaways

By viewing logistics as a potential profit driver rather than just an operational necessity, the company was able to:

- Increase sales through improved customer service

- Reduce costs through operational efficiencies

- Free up capital by optimising inventory and fixed assets

This holistic approach to logistics not only improved TechGadget’s ROI but also positioned the company for sustainable growth in a competitive market.