Incoterms®, or International Commercial Terms, are a set of globally-recognised international trade rules for the sale of goods. They outline the rules and responsibilities of both the sellers (exporter) and the buyers (importer) use in international and domestic trade contracts.

How Incoterms® Work

The Incoterms® rules describe:

- Obligations.

Who does what as between seller and buyer.

- Examples include:

- Organizing transportation

- Arranging insurance

- Obtaining necessary documents (like shipping documents)

- Securing export or import licenses

- Examples include:

- Risk.

- Point at which the risk of loss or damage to the goods transfers from the seller to the buyer.

- It clarifies when the seller is considered to have completed the “delivery” of goods.

- After this point, if anything happens to the goods, it’s the buyer’s responsibility.

- Costs.

Which party is responsible for which costs.

- Examples of costs include:

- Transportation fees

- Packaging costs

- Loading and unloading charges

- Costs for inspections or security-related procedures

- Examples of costs include:

The Incoterms® rules cover these areas in a set of ten articles:

- Structure:

- There are 10 sets of articles, each with two parts (A and B).

- ‘A’ articles describe the seller’s obligations.

- ‘B’ articles describe the buyer’s obligations.

- Numbering:

- Each rule has 10 articles, numbered A1/B1 through A10/B10.

- The matching numbers (e.g., A1 and B1) deal with the same topic from the seller’s and buyer’s perspectives.

- The 10 articles cover:

- A1/B1: General Obligations

- A2/B2: Delivery/Taking Delivery

- A3/B3: Transfer of Risks

- A4/B4: Carriage

- A5/B5: Insurance

- A6/A6: Delivery Transport Document

- A7/B7: Export/Import Clearance

- A8/B8: Checking/Packaging/marking

- A9/B9: Allocation of Costs

- A10/B10: Notices

Things Incoterms® Don’t Cover

While Incoterms® define the roles and responsibilities for the shipment of products, they do not cover all shipping-related activities.

Inconterms don’t:

- Specify export documentation required to clear goods at customs.

- Specify product labelling nor packaging to meet market requirements.

- Address all sale conditions.

- Identify the goods sold and list the contract price.

- Reference the payment method or timing agreed upon.

- Determine when ownership of the goods transfers from seller to buyer.

- Address liability for non-conforming goods, delayed delivery, or dispute resolution mechanisms.

Incoterms® 2020 Rules

Incoterms® rules are typically represented as 3-letter acronyms. The most recent version of Incoterms® was released in 2020.

They are divided into two categories:

- Rules for Multimodal Transport.

- Rules for Sea and Inland Waterway Transport.

Rules for intermodal transport

EXW (Ex Works)

EXW (Ex Works) means the seller makes the goods available at their premises (e.g., factory, warehouse) or another named place (like a workshop).

- The buyer is responsible for all costs and risks involved in taking the goods from the seller’s premises to the final destination.

Seller’s Responsibilities:

- Provide access to the goods.

- Prepare the commercial invoice.

- Ensure proper packaging, labeling, and quality of the goods.

Buyer’s Responsibilities:

- Collect the goods from the seller’s premises.

- Handle export formalities, if applicable.

- Arrange transportation, pay freight, and insurance.

- Bear all risks and costs after the goods are made available.

FCA (Free Carrier)

FCA (Free Carrier) means the seller delivers the goods to a carrier or another person nominated by the buyer at the seller’s premises or another named place.

Seller’s Responsibilities:

- Deliver the goods to the carrier nominated by the buyer.

- Prepare the commercial invoice.

- Ensure proper packaging, labeling, and quality of the goods.

- Pay export duties and taxes.

Buyer’s Responsibilities:

- Pay terminal handling charges at the port of origin and destination.

- Pay freight charges.

- Bear the risk and cost of delivery from the agreed place of delivery.

- Pay import duties and taxes at the destination.

CPT (Carriage Paid To)

CPT (Carriage Paid To) means the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place. The seller also pays for the carriage of the goods to the named place of destination.

Seller’s Responsibilities:

- Deliver the goods to the agreed place.

- Pay the freight charges to the named destination.

- Prepare the commercial invoice.

- Ensure proper packaging, labeling, and quality of the goods.

- Pay export duties and taxes.

Buyer’s Responsibilities:

- Pay terminal handling charges at the port of destination.

- Bear the unloading cost at the destination.

- Bear the cost and risk of delivery to the final destination.

- Pay import duties and taxes.

CIP (Carriage and Insurance Paid To)

CIP (Carriage and Insurance Paid To) means the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place. The seller must also pay for insurance coverage and the carriage of the goods to the named place of destination.

Seller’s Responsibilities:

- Pay for the insurance and carriage to the named destination.

- Prepare the commercial invoice.

- Ensure proper packaging, labeling, and quality of the goods.

- Pay export duties and taxes.

- Pay freight charges.

Buyer’s Responsibilities:

- Pay terminal handling charges at the port of destination.

- Bear the unloading cost at the destination.

- Bear the cost and risk of delivery to the final destination.

- Pay import duties and taxes.

DPU (Delivered at Place Unloaded)

DPU (Delivered at Place Unloaded) means the seller delivers the goods, once unloaded, at a named place. It was formerly known as Delivered at Terminal (DAT).

Seller’s Responsibilities:

- Deliver and unload the goods at the named place.

- Pay for transportation to the named place, including freight charges.

- Handle export clearance formalities.

- Pay terminal handling charges at the port of destination.

- Ensure the goods arrive at the agreed place.

Buyer’s Responsibilities:

- Pay import duties and taxes.

DAP (Delivered at Place)

Definition:

- DAP (Delivered at Place) means the seller delivers the goods to the buyer at an agreed place, ready for unloading.

Seller’s Responsibilities:

- Deliver the goods to the agreed destination.

- Pay for transportation, including freight charges.

- Handle export clearance formalities.

- Ensure the goods arrive at the destination.

- Pay terminal handling charges at the port of discharge.

Buyer’s Responsibilities:

- Pay import duties and taxes at the destination.

- Bear the unloading charges at the port of destination.

DDP (Delivered Duty Paid)

DDP (Delivered Duty Paid) means the seller delivers the goods to the buyer, cleared for import, at the named place of destination. The seller bears all costs and risks, including duties, taxes, and customs formalities.

Seller’s Responsibilities:

- Deliver the goods to the agreed destination.

- Pay for transportation, including freight charges.

- Handle both export and import clearance formalities.

- Pay duties, VAT, and other local charges.

- Ensure the goods arrive at the destination.

Buyer’s Responsibilities:

- Unload the goods at the destination.

Rules for Sea and Inland Waterway Transport

FAS (Free Alongside Ship)

FAS (Free Alongside Ship) means the seller delivers when the goods are placed alongside the vessel nominated by the buyer at the named port of shipment.

Seller’s Responsibilities:

- Deliver the goods alongside the vessel.

- Handle export clearance formalities.

- Pay transportation to the agreed port.

- Pay export duties.

Buyer’s Responsibilities:

- Arrange and pay for the carriage from the port.

- Bear the risk from when the goods are alongside the ship.

- Pay import duties and taxes.

- Handle loading and unloading costs.

FOB (Free On Board)

FOB (Free On Board) means the seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment.

Seller’s Responsibilities:

- Deliver the goods on board the vessel.

- Handle export clearance formalities.

- Pay transportation to the port.

- Cover all risk up to the point of delivery.

Buyer’s Responsibilities:

- Pay the freight charges.

- Pay import duties and taxes.

- Handle loading and unloading costs

CFR (Cost and Freight)

CFR (Cost and Freight) means the seller delivers the goods on board the vessel and pays the costs and freight to bring the goods to the named port of destination.

Seller’s Responsibilities:

- Deliver the goods on board the vessel.

- Pay the freight to the destination port.

- Handle export clearance formalities.

- Pay terminal handling charges at the port of origin.

Buyer’s Responsibilities:

- Pay terminal handling charges at the destination.

- Bear the cost and risk of delivery to the final destination.

- Pay import duties and taxes.

CIF (Cost, Insurance and Freight)

CIF (Cost, Insurance and Freight) means the seller delivers the goods on board the vessel and pays the costs, freight, and insurance to bring the goods to the named port of destination.

Seller’s Responsibilities:

- Deliver the goods on board the vessel.

- Pay the freight and insurance to the destination port.

- Handle export clearance formalities.

- Pay terminal handling charges at the port of origin.

Buyer’s Responsibilities:

- Pay terminal handling charges at the destination.

- Bear the cost and risk of delivery to the final destination.

- Pay import duties and taxes.

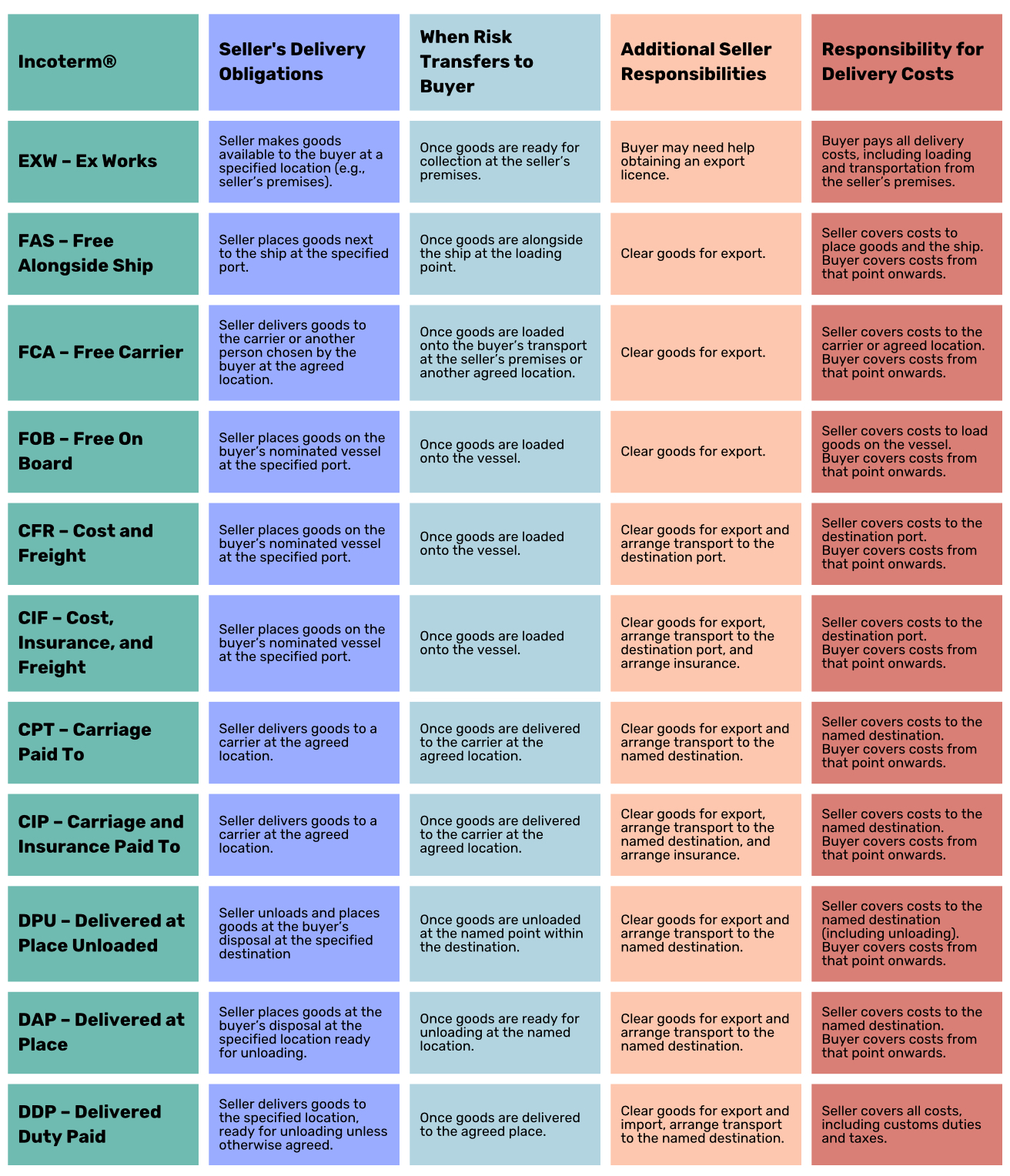

The table below outlines each Incoterms® 2020 rule and the responsibilities of you and your buyer under each rule.

The following images summarise each Incoterms® cost responsibilities.

Incoterms® 2020 cost responsibility for multimodal transport

Incoterms® 2020 cost responsibility for sea and inland waterways

Incoterms® usage

For Incoterms® to be effective, both the seller and the buyer must explicitly agree to use them and incorporate the specific terms into their contract.

When the mode of transport is uncertain at the time of contract execution, it’s advisable to use multimodal or combined transport Incoterms®.

This flexibility ensures that the chosen Incoterm® can accommodate any potential changes in the transportation method, providing clarity and minimising disputes.

Example scenario

To use Incoterms® 2020 in a contract, you should explicitly reference the term, location, and revision year.

Let’s consider a scenario where a company is selling goods but is unsure if the transport will be by sea, air, or land due to potential production delays. In this case, choosing a multimodal Incoterm® like CIP (Carriage and Insurance Paid To) can be beneficial.

Here’s how it can be incorporated into the contract:

- Contract Clause:

“Seller agrees to deliver the goods to the buyer at the named place of destination, 123 Main Street, New York, NY, USA, under the terms CIP (Carriage and Insurance Paid To) as per Incoterms® 2020. The seller will bear all costs, including carriage and insurance, until the goods are handed over to the carrier. The risk will transfer to the buyer upon delivery to the first carrier.”

In this example:

- CIP (Carriage and Insurance Paid To) is the chosen Incoterm.

- 123 Main Street, New York, NY, USA is the specific delivery location.

- Incoterms® 2020 is the revision year specified to avoid ambiguity.

This reference typically appears in the pricing section of the contract, but it can be included anywhere, as long as it is clearly stated. The key is to ensure that the term is explicitly mentioned along with the specific location and the revision year (2020 in this case).

Do's and Don'ts of Using Incoterms® 2020

- Incorporate Incoterms® 2020 Correctly: State the exact delivery point, especially for ports or terminals.

- Check Routes and Delivery Procedures: Ensure your carrier’s routes and delivery procedures align with your obligations, risks, and costs.

- Advise Buyers of Returns Procedures

- Consider Insurance Requirements: Ensure adequate insurance, especially if not using CIF/CIP terms.

- Clarify Contract Details: Define all points not covered by Incoterms® 2020 in the contract, like the title of goods

- Review Terms and Trading Conditions: Check if terms allow a lien over your goods.

- Check Licensing Requirements: Verify export and import licensing requirements.

- Avoid terms that impose excessive risks and obligations, like DDP.

- Use EXW for VAT Proof: Do not use EXW if you need VAT export proof or if loading goods onto customer vehicles (use FCA instead).

- Don't accept orders based on rules you don’t fully understand.

- Use Unsuitable Terms for Cargo/Transport: Avoid using terms unsuitable for your cargo or transport mode, like FOB for loose cargo.

- Confuse Legal Obligations with Incoterms®: Remember, Incoterms® 2020 are not legal requirements but clarify responsibilities.

- Use Foreign or Alternative Terms: Do not use foreign or alternative terms not part of Incoterms® 2020 (e.g., FOT, Frei Haus, and Franco Domicile).